Invantive software and the euro

In response to questions of relations you can read in this contribution how you can prepare the Invantive products for a situation in which the composition of the euro zone might change or the guilder would be reintroduced. This information is subject to change considering the uncertainties around the continuation of the euro and possible conversion scenarios.

This contribution is relevant for users with the build 42 or newer of the products Invantive Estate/Vision with an ongoing maintenance contract. For older versions this contribution might not be applicable. For Invantive Control, Invantive Composition, links with financial packages (such as Axapta and Exact Globe) and customized work the rule applies that the implementation partner can offer support for the maintenance of calculation templates, documents and custom work. No amounts are registered within Invantive Producer, Invantive Studio and Invantive Query Tool. A euro exit is expected to have no influence on the functioning of these products.

Invantive Estate and Invantive Vision

In Invantive Estate/Vision you can consolidate your financial project data originating from multiple accountancy systems for multiple legal entities. You can manually add extra “soft” information according to the latest estimates. In the end this will lead to an organization-wide overview of the project portfolio. Then it will not matter in which legal entity a project is executed. You can request the project portfolio for any moment in the past. This is a need that mainly exists for listed enterprises and companies that are supervised by for example DNB.

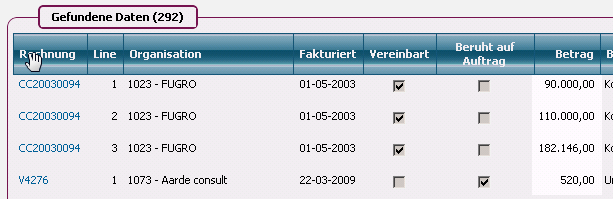

With Invantive Estate/Vision you can also conclude operational activities and processes like service management with work orders, sales of housing (“buyer’s invoicing”) and sales (relation data and sale opportunities).

For all users: conversion

For all users a number of adaptions will be needed to Invantive Estate/Vision (next to adaptions to the financial package) in the case of a possible euro exit:

- The actual amounts would need to be converted, for example prices in price lists, realization numbers out of the accounting, cash flows and prognoses. Support by an Invantive consultant is necessary for this.

- All amounts in the data warehouse would need to be converted so that the historical course of amount before and after the euro exit fit together.

- The conversion method needs to be connected to external systems like the accounting of the legal entities.

According to the current views there will no further functional adaptations needed if your invoices are only bound to relations in the Netherlands and you are an autonomous legal entity.

For complex situations: functional adaptions

It is possible that functional adaptions might be needed if:

- your organization is part of a legal entity which is located abroad;

- or your organization is part of a legal entity that reported in a currency other than the guilder before 2000;

- or your organizations sends its invoices from Invantive Estate or Invantive Vision to relations outside of the Netherlands, in which case it is to be expected that the customer will not accept an invoice in Dutch guilders.

All amounts are a functional currency, which is normally the euro. Depending on the situation you would need to determine for each amount in what currency the registration will take place in the case of a euro exit.

For example for a working order the amount could be on the price list in Dutch Guilders for Dutch customers. For a customer in a country with a different currency a price list could be used which is a copy of the Dutch price list, but with a different currency in the description. In the financial package you can then choose the right currency. Any exchange rate differences would need to be booked within the financial package

For financial consolidation the realization numbers from the accounting would need to be converted to the functional currency. The convertion is based on a to be determined exchange rate methodology. It is not possible and will not be possible to execute the financial consolidation of projects with multiple currencies. Prognosis mutations would need to be determined extra comparable because of the exchange rate difference and possibly booked into the project.

As soon as new information is available concerning the possibilities and limitations of Invantive Estate/Vision in the case of a possible euro exit it will be published.